Condo Insurance in and around Spring

Townhome owners of Spring, State Farm has you covered.

Insure your condo with State Farm today

Condo Sweet Condo Starts With State Farm

As with any home, it's a good idea to make sure you have coverage for your condo. State Farm's Condo Unitowners Insurance has great coverage options to fit your needs.

Townhome owners of Spring, State Farm has you covered.

Insure your condo with State Farm today

Agent Noah Labauve, At Your Service

Things do happen. Whether damage from weight of ice, vandalism, or other causes, State Farm has dependable options to help you protect your condominium and personal property inside against unanticipated circumstances. Agent Noah LaBauve would love to help you provide you with coverage that is personalized to your needs.

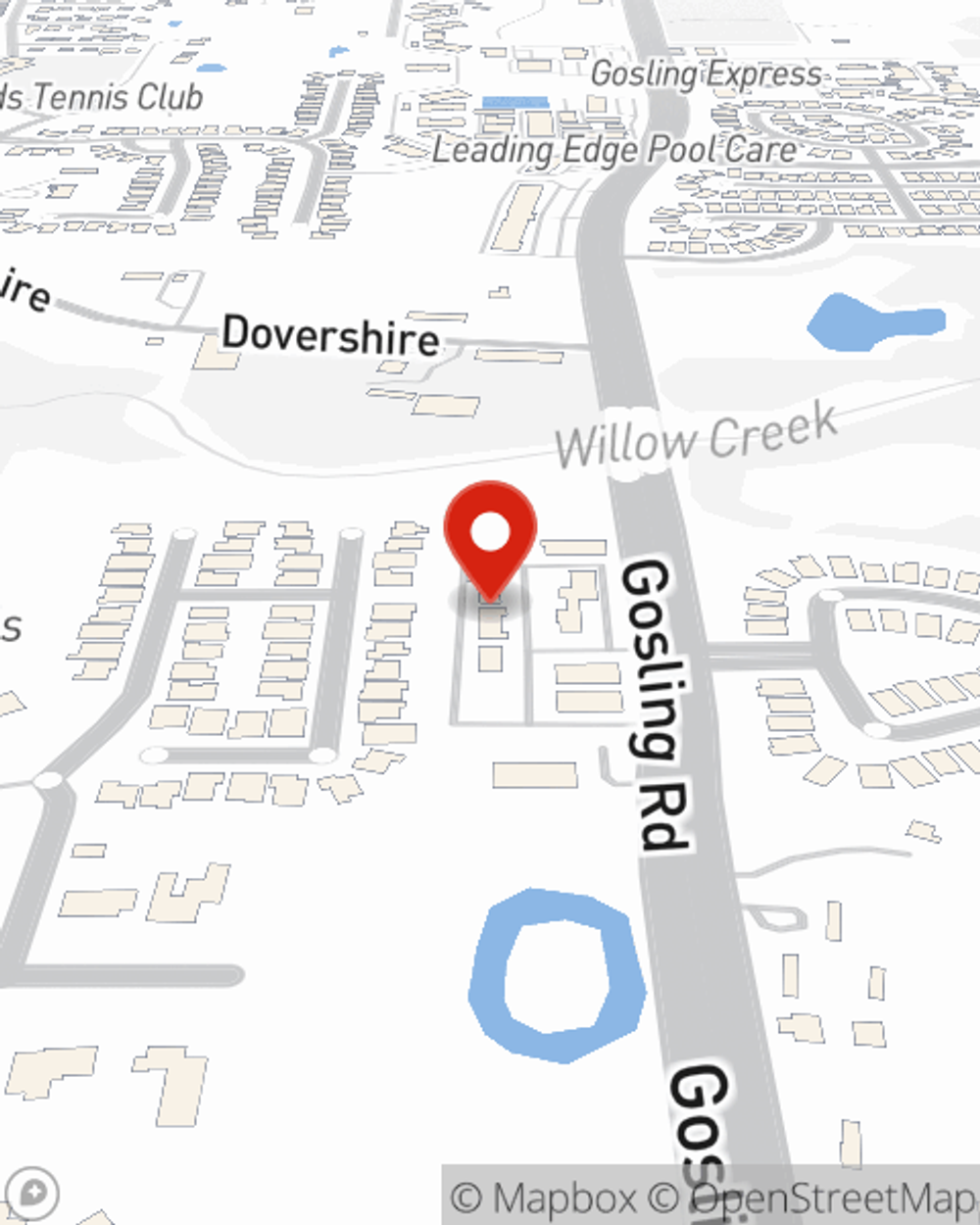

If you're ready to bundle or find out more about State Farm's great condo insurance, call or email agent Noah LaBauve today!

Have More Questions About Condo Unitowners Insurance?

Call Noah at (832) 761-7500 or visit our FAQ page.

Simple Insights®

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.

A condo maintenance checklist for every season

A condo maintenance checklist for every season

Whether you rent or own a condo, it's important to pay attention to maintenance. Get your condo ready for upcoming weather with these maintenance tips.

Noah LaBauve

State Farm® Insurance AgentSimple Insights®

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.

A condo maintenance checklist for every season

A condo maintenance checklist for every season

Whether you rent or own a condo, it's important to pay attention to maintenance. Get your condo ready for upcoming weather with these maintenance tips.